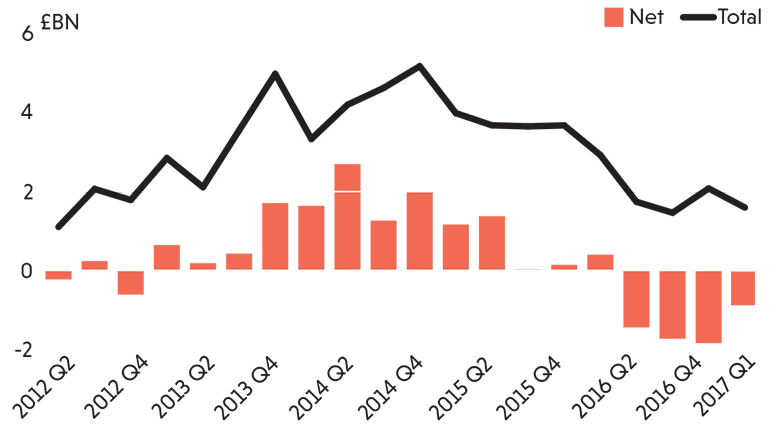

UK institutional funds reduced their property holdings by a net £4.6bn last year as some of the biggest names in the business had to sell off property to battle instability.

This has been followed by a further net reduction of £828m in the first quarter of this year, according to Savills research.

John Forbes’ report, commissioned by AREF on last year’s open-ended retail funds crisis, was published in full this week and recommended that a more diverse range of property investment products should be offered to investors that lock in their money for longer.

This is borne out by data from AREF and MCSI’s latest property fund handbook, covering 56 property funds with a combined value of £61bn, that shows open-ended UK retail funds returned -4% last year while property funds in general, which includes longer-term products for institutional investors, returned 1.7%.

UK institutional investment into commercial property

Property fund returns by fund type

Authorised property unit trusts, seven of which suspended trading last summer, returned -4% in 2016, down significantly from the 4.3% five-year average. Those funds tend to be more volatile because they are open to daily trading, which means investors can redeem their holdings quickly, whereas institutional investors look for long-term, stable investments.

Most important: sector exposure or fund structure?

Among balanced funds, which invest across multiple sectors, structure plays a bigger role in returns than levels of exposure to individual sectors. Retail, which was among the worst performers on the IPD index last year, should have posted lower returns – but the picture is more complicated. While Aviva Investors Property Trust, the PUT with the least exposure to retail, does have the highest return among its fund type at -3.8%, the difference between the best and worst performing fund is less than four percentage points. Each of the other types had similar differences between the highest and lowest performers, but the overall range was much wider at 16 percentage points.

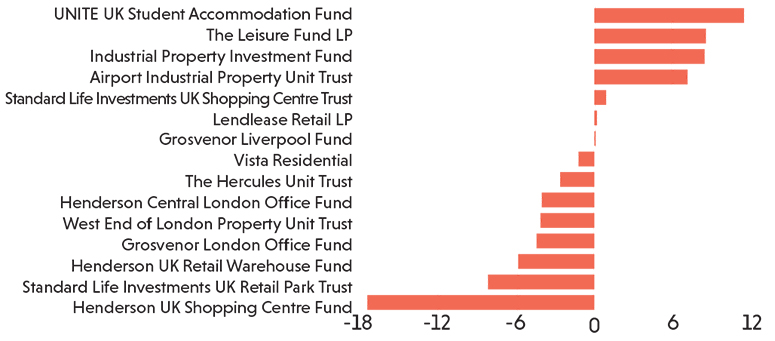

Specialist funds, which target individual sectors, are more indicative of the relative performance of different parts of the UK property market. Only student housing, leisure and industrial funds returned more than 1%. The worst performers held shopping centre, retail warehouse and office assets.

Top five funds by return, 2016

| Fund | Total return 2016 | Five-year annual total return | Type of fund | Biggest sector investment | Portfolio size (£m) |

|---|---|---|---|---|---|

| Unite UK Student Accommodation Fund | 11.4 | 15.2 | Specialist | Student housing (99.3%) | 2,287.9 |

| Leisure Fund | 8.5 | 11.8 | Specialist | Leisure (100%) | 506.4 |

| PGIM Real Estate UK Ground Lease Fund | 8.4 | 8.9 | Long income | Other – hotel (68.8%) | 428.8 |

| Industrial Property Investment Fund | 8.4 | 14.5 | Specialist | Industrial (95.7%) | 1,714.4 |

| Airport Industrial Property Unit Trust | 7.1 | 12 | Specialist | Industrial (97.2%) | 575.9 |

Bottom five funds by return, 2016

| Fund | Total return, 2016 | Five-year annual total return | Type of fund | Biggest sector investment | Portfolio size (£m) |

|---|---|---|---|---|---|

| Henderson UK Retail Warehouse Fund | -5.8 | 5.2 | Specialist | Retail (99.5%) | 1,067.80 |

| Aberdeen Property | -6.2 | 4.3 | Balanced | Retail (38.7%) | 1,962.60 |

| M&G Property | -7.6 | 3.9 | Balanced | Retail (35%) | 3,380.80 |

| Standard Life Investments UK Retail | -8.1 | 0.7 | Specialist | Retail (99.6%) | 527.1 |

| Henderson UK Shopping Centre | -17.3 | 2.6 | Specialist | Retail (99.6%) | 649 |

Source: AREF/MSCI

To send feedback, e-mail karl.tomusk@egi.co.uk or tweet @ktomusk or @estatesgazette